Capital gains calculator for home sale transactions

If you have less than a 250000 gain on the sale of your home or 500000 if youre married filing jointly you will not have to pay capital gains tax on the sale of your home. The account earns 20 interest.

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Capital Gains Tax was introduced on 1 October 2001.

. If you sell your home and realize a capital gain up to 500000 of that gain may be exempted. Net capital gains from selling collectibles such as coins or art are taxed at a maximum 28 rate. How Much Is the Capital Gains Tax.

Short-term capital gains are gains apply to assets or property you held for one year or less. Many home sellers dont have to report the sale to the IRS. Gain on Sale or Trade of Depreciable Property.

As long as you meet some basic residency requirements and your home-sale profit is 250000 or less 500000 for married-filing-jointly home sellers its not taxable and you dont have to. The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25 rate. Taxation of Chargeable Gains Act 1992 - Section 18 - Transactions between connected persons.

Your capital gain would be. You would only pay the tax on the profit on your home if its above a specific amount. ABC of Capital Gains Tax for Individuals Issue 12 i ABC of Capital Gains Tax for Individuals.

CGT on Gifted Property. Tom Cymer CFP CRPC CFA Opulen Financial Group LLC. You open a savings account at your local bank and deposit 800.

Capital losses from investmentsbut not from the sale of personal propertycan typically be used to offset capital gains. Tax code section 1031 provides a way to defer the capital gains tax on the profit you make on the sale of a rental property by rolling the proceeds of the sale into a new property. Any profit or gain that arises from the sale of a capital asset is a capital gain.

The capital gains from your home sale remember thats the profit not the total purchase price is under 250000. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. Short-term capital gains are treated as income and are taxed at your marginal.

You later sell all 100 shares for 145 per share or 14500. But its important to understand the rules when it comes to. This gain is charged to tax in the year in which the transfer of the capital asset takes place.

The IRS treats home sales a bit differently than most other assets generating capital gains though. Long-Term Capital Gains Tax in Georgia. You can utilize a qualified 1031 exchange intermediary escrow company for this type of.

You and your siblings didnt use the property for personal purposes. What is the capital gains tax on gifts to children. Long-term capital gains are when you hold an investment for more than a year after purchased.

The base cost is the purchase. For details on Form 8949 see Reporting Capital Gains and Losses in chapter 4 and the Instructions for Form 8949. Your basis in the stock is 12000.

They are subject to ordinary income tax rates meaning theyre taxed federally at either 10 12 22 24 32 35 or 37. In a hot stock market the difference can be significant to your after-tax profits. If you sold your home for 500000 you would not pay capital gains taxes on the entire 500000.

For example say you purchase 100 shares of a stock for 120 per share. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable. It comes about most often for taxpayers when their home or investment property is sold for a profit gain ie.

However not all capital gains are treated equally. That figure only applies to people filing as a single homeowner. Long-term capital gains apply to assets that you held for over one year and are taxed.

If youre filing jointly as a married couple that capital gains exemption goes up to 500000. Long-term capital gains are taxed at a lower rate than short-term gains. For the 2020 tax year the short-term capital gains tax rate equals your ordinary income tax rate your tax bracket.

Short-term capital gains are when you buy an investment and sell it in a year or less. Then if you multiply that number by the 15 capital gains it yields 3750 which would be the tax consequences for this transaction. You also receive a 15.

You sold the house to an unrelated person. Regarding capital gains on inherited property and losses you can claim a capital loss on inherited property if you sold it and all of these are true. Capital Gains Tax.

It should accordingly not be used as a legal reference. The market value of a property is based on the price which might reasonably be expected to fetch on a sale in the open market and is based on the market value of the. Government taxes different kinds of income at different rates.

It forms part of normal income tax and is based on the sliding tax tables for individuals. Some types of capital gains such as profits from the sale of a stock that you have held for a long time are generally taxed at a more favorable rate than your salary or interest income. Long-term capital gains tax rate.

Specific rules must be followed to properly complete the 1031 exchange. Know about LTCG STCG assets calculation exemption how to save tax on agricultural land. Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

What is Capital Gains Tax. Capital gains tax is the tax paid on profits you make from selling an investment for more than it was purchased for. If you have 50000 in long-term gains from the sale of one stock but 20000 in long-term losses from the sale of another then you may only be taxed on 30000 worth of long-term capital gains.

The proceedsselling price is more than the base cost. You sold the house in an arms length transaction. This guide provides a simple introduction to capital gains tax CGT at its most basic level and contains insufficient detail to accurately determine CGT under most practical situations.

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Calculating Crypto Taxes In Uk W Share Pooling Koinly

How To Compute Capital Gains Tax On Sale Of Real Property Business Tips Philippines

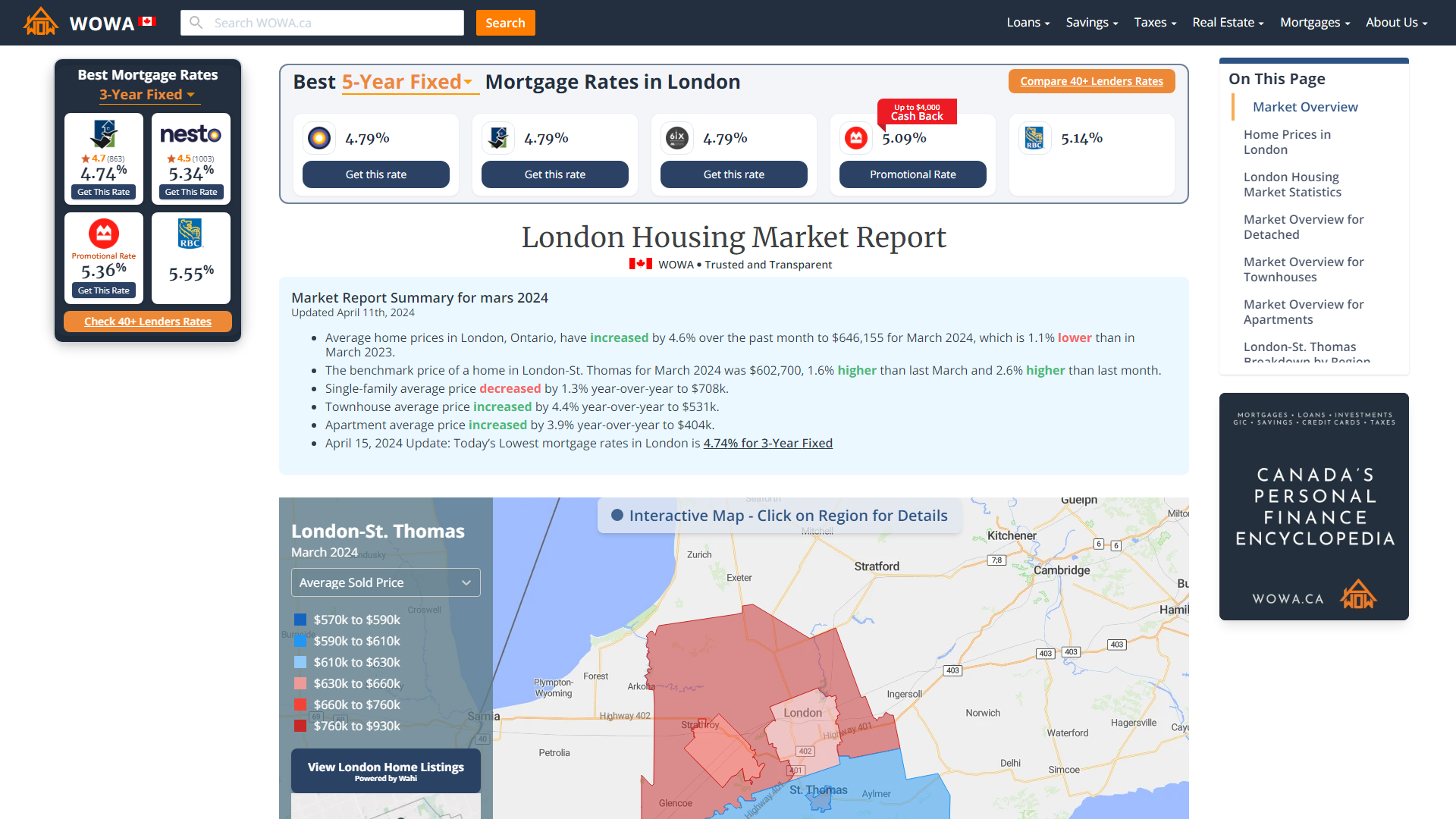

London Housing Market Report Jul 8th 2022 Update Interactive Map Wowa Ca

Ontario Real Estate Commission Calculator Wowa Ca

The Ultimate Crypto Tax Guide For Canadians In 2022 Hardbacon

Weekly Real Estate Podcasts Vancouver Real Estate Podcast

Why Real Estate Agents Shouldn T Answer Tax Questions

/GettyImages-1327236972-5c9b68205a7740488795ef88af30ebfe.jpg)

How Capital Gains Tax Works On Pension Funds

Calculating Crypto Taxes In Uk W Share Pooling Koinly

Dyk Capital Gain Is Computed Based On Stamp Duty Value Mint

How To Calculate And Pay Tax After Someone Dies The Gazette

How To File Itr 2 Form With Capital Gains Complete Steps Faqs

How To Avoid Capital Gains Tax On Real Estate Sales Shared Economy Tax

Your Queries Income Tax How Is Capital Gains Tax Calculated With Reference To Selling Of Land The Financial Express

/GettyImages-758582977-9ecf7d7f6af1477587171388cb221f4c.jpg)

Recognized Loss Definition

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State